While the overwhelming majority of our customers meet their payment obligations, there is inevitably a small level of debt that we must manage.

Our objective is to manage the recovery of debt in a thorough and timely manner by achieving payment of any outstanding liability.

Nevertheless, a comprehensive review of our debt management strategies identified efficiency gains in how we recover debt. In 2016-17, work continued to develop specific enhancements, including a flexible online payment arrangement system to make it easier for customers to do business with us.

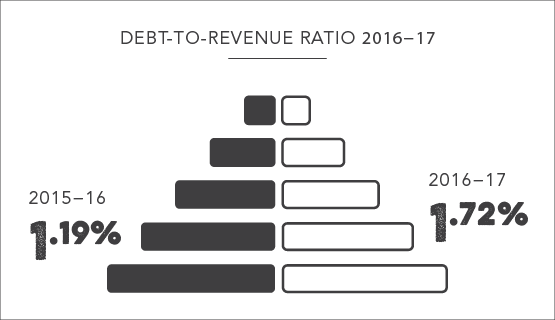

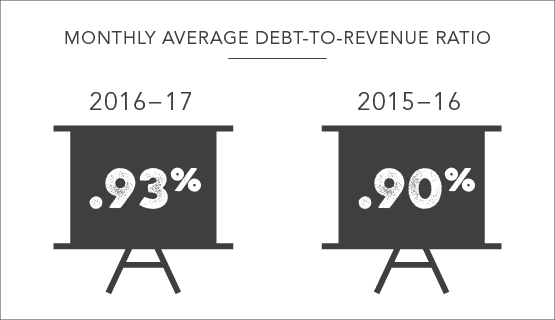

In real terms our debt level is consistently below 2 per cent of the total revenue collected in a year, reflecting our high performance standards in maintaining debt at low levels.

This year, we achieved our debt-to-revenue ratio despite an increasing customer base, growth in revenue receipts, and a once-again challenging 2017 land tax issue cycle. We also increased our focus on resolving smaller value, but larger volume, land tax debts, resulting in the resolution of older debt cases.